Secure Your Future with Smart Insurance & Investment

From protecting your family with the right insurance to growing your wealth with mutual funds, we provide expert guidance for a secure financial future.

Explore Our Services

From protecting your family with the right insurance to growing your wealth with mutual funds, we provide expert guidance for a secure financial future.

Explore Our Services

With an amazing experience in the financial sector, we aim to simplify insurance and investments for everyone. We believe in empowering our clients with knowledge to mitigate the impact of unexpected events and to build a strong financial foundation for a secure and prosperous future.

Cashless hospitalization and protection against rising medical costs.

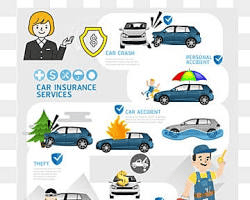

Financial protection against vehicle accidents and damages.

Ensures financial security for your loved ones in your absence.

Grow your wealth with diversified investments managed by experts.

We start with a free consultation to understand your financial goals and needs.

We create a personalized plan with the best insurance and investment options.

We help with all the paperwork and ensure a smooth policy issuance.

We provide continuous support, from claim assistance to portfolio reviews.

Understand the tools that secure your life and grow your wealth. Learn why insurance is a necessity and how mutual funds can help you achieve your financial dreams.

In an era of rising medical inflation, a single hospitalization can deplete your life savings. Health Insurance acts as a shield, ensuring you get the best medical care without the financial burden.

Motor insurance is mandatory and acts as a safety net, protecting you financially from accidents, theft, or natural disasters involving your vehicle.

Life Insurance is a promise to your family that they will be financially secure, even in your absence. It's a fundamental act of love and responsibility.

Mutual Funds are an ideal investment vehicle for creating long-term wealth. They offer professional management and diversification for your investments.

We offer tailored insurance and investment plans that fit your specific requirements and financial goals.

Our experienced advisors are here to guide you, helping you make informed decisions with clarity and confidence.

We believe in quick service and complete transparency, whether it's claims support or investment advice.

"Sridha FinServe made the entire insurance process so simple and clear. Their personalized advice was invaluable. Highly recommended!"

"I started my first SIP with their guidance. The team is very patient and knowledgeable. I feel much more confident about my financial future now."

"Excellent service and support during my health insurance claim. They handled everything efficiently and were always available to help."

Fill out the form below to schedule a free consultation. Let's build your secure financial future together.